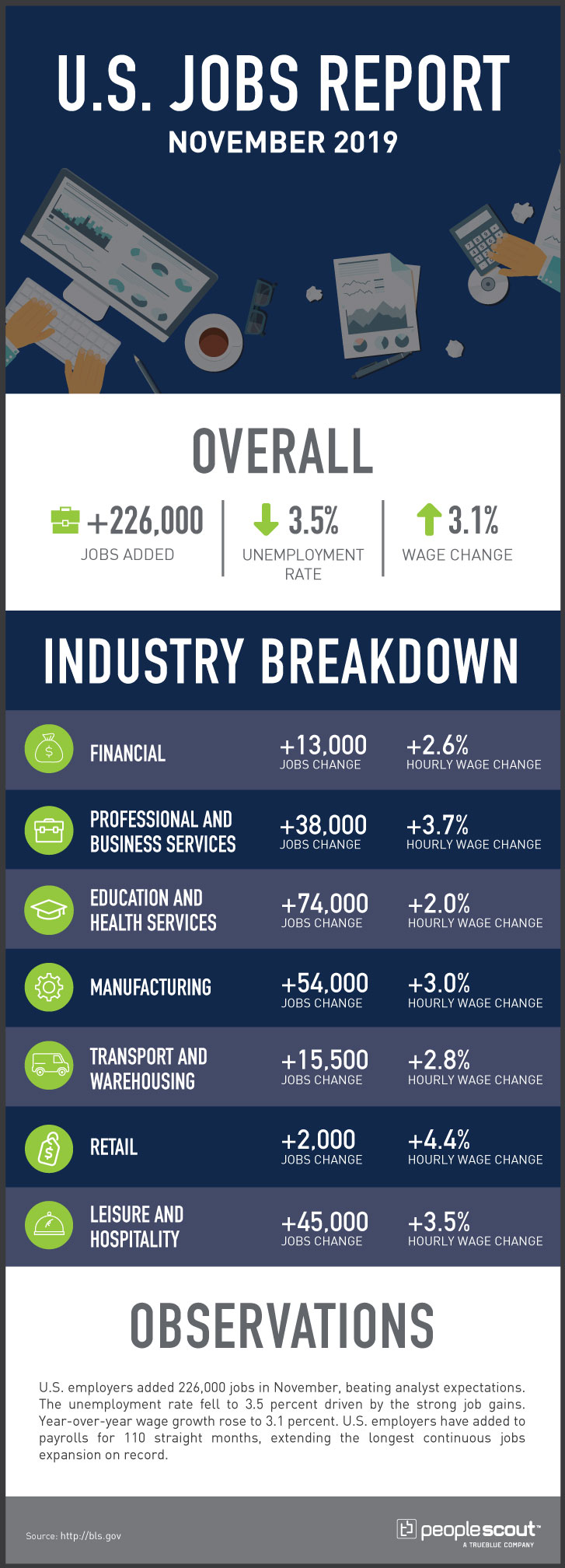

The Labor Department released its November jobs report which shows that U.S. employers added 266,000 jobs in November, beating analyst expectations. The unemployment rate fell to 3.5%, a 0.1% decrease from last month. The rate’s decrease was caused by strong job growth with little change to the labor participation rate. Year-over-year wage growth rose 0.1 percentage points to 3.1%. U.S. employers have added to payrolls for 110 straight months, extending the longest continuous jobs expansion on record.

The Numbers

266,000: The economy added 266,000 jobs in November.

3.5%: The unemployment rate fell to 3.5%.

3.1%: Average hourly wages increased at a rate of 3.1% over the last year.

The Good

Reporting on the drop in unemployment and annual wage growth that is well ahead of the inflation may have been overshadowed by the robust (and unexpected) job growth last month. The monthly increase was the best since January’s 312,000 and well ahead of the November 2018 total of 196,000. November’s strong job expansion was fueled by gains in several key sectors. There were 45,000 health care jobs added with a jump in ambulatory health care services (up 34,000) and in hospitals (up 10,000). Over the last year, 414,000 health care jobs have been added to the U.S. economy.

Employment in professional and technical services rose by 31,000 in November and by 278,000 over the last year. Employment in leisure and hospitality continued to grow, adding 45,000 positions last month and a total of 219,000 jobs in just the last four months. Even the embattled retail sector showed modest job growth (up 2,000) which reflected rising employment in general merchandise stores (up 22,000) and in motor vehicle and parts dealers (up 8,000).

The Bad

Some of the sector job gains are not as strong as they initially appear. The increase in retail jobs was offset by a loss of 18,000 positions in clothing and clothing accessories stores during the month that kicked off the traditional Christmas shopping season. While manufacturing gained 54,000 jobs last month following a decline of 43,000 in October, 41,000 of these were in auto manufacturing generated by thousands of General Motors workers who were returning to work after being on strike.

Despite the strong monthly report, job growth has averaged 180,000 per month this year compared with an average monthly gain of 223,000 in 2018. While the job market is expanding, it is doing so at a slower pace than last year. The most recent BLS report on U.S. job openings showed that they have fallen to their lowest level in a year and a half. While the number of jobs grew last month, the number of those employed part-time for economic reasons, which was reported as 4.3 million people, changed little in November. These individuals, who would have preferred full-time employment, were working part-time because their hours had been reduced or they were unable to find full-time jobs. Despite strong demand, employers were unable to significantly attract those in this category into the full-time workforce.

Plan for Continuing Tight Labor Markets

The November jobs report was perceived by many as demonstrating the continuing strength of the U.S. economy, despite ongoing concerns over the impact of tariffs and trade disputes. As the new year approaches, it is noteworthy that this is the first decade in which the U.S. has not experienced a major recession since the 19th century. Even as job openings fall, the number is still larger than the number of unemployed Americans. Fears of a recession being on the horizon are fading for some analysts.

As the economy grows, so does the demand for talent and businesses are planning for growth. For example, in the small business sector which has been a major driver of job growth, approximately 60% of the 654 employers surveyed in November said they planned to expand their headcount in 2020 and just 4% were planning cuts.

While employers need to consider an array of directions the economy may take next year in their workforce planning, the optimism generated by the November jobs report indicates that expertise in both attracting and retaining talent will continue to be as crucial to the success of an enterprise in the coming years as it has been in the prosperous decade which is about to end.