The strong job growth and tight labor markets which characterized most of the world’s leading economies in 2018 continued in the first quarter of 2019. And while the overall economic headlines have been positive, employers have been challenged by record high job openings, rising wages and uncertainty over trade. For many economies, 2019 got off to a strong start, but the outlook for the remainder of the year is uncertain.

Low Unemployment: The Diminishing Available Talent Pool and a Tight Labor Market

The United States ended the first quarter with an unemployment rate of just 3.8%. While the partial government shutdown may have impacted the negligible job growth in February, the economy still added an average of 180,000 jobs per month in the first quarter. This is robust job growth by any measure, but it is smaller than the 223,000 jobs created per month in 2018. These numbers suggest that job growth is still strong but the pace of job creation is slowing.

U.S. employers posted nearly 7.6 million open jobs at the start of the year, a near record high and a sign that businesses are continuing to compete for a diminishing pool of available talent. In March, it was estimated that there were about 1 million more open jobs than unemployed workers.

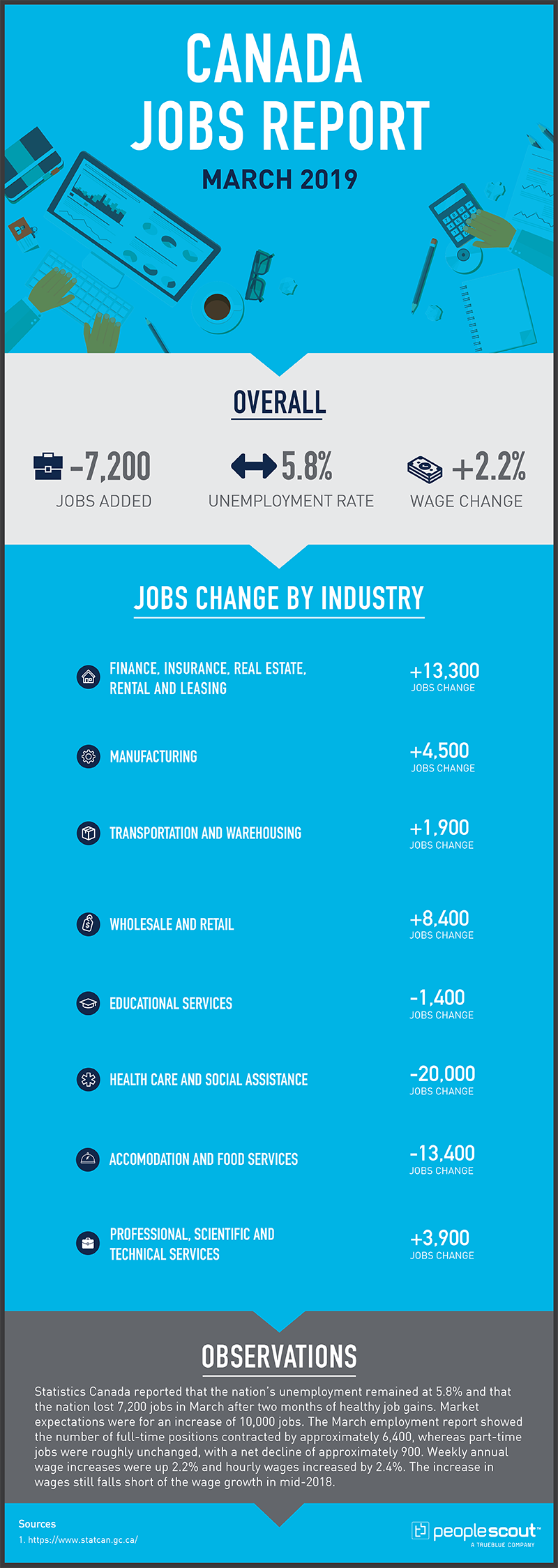

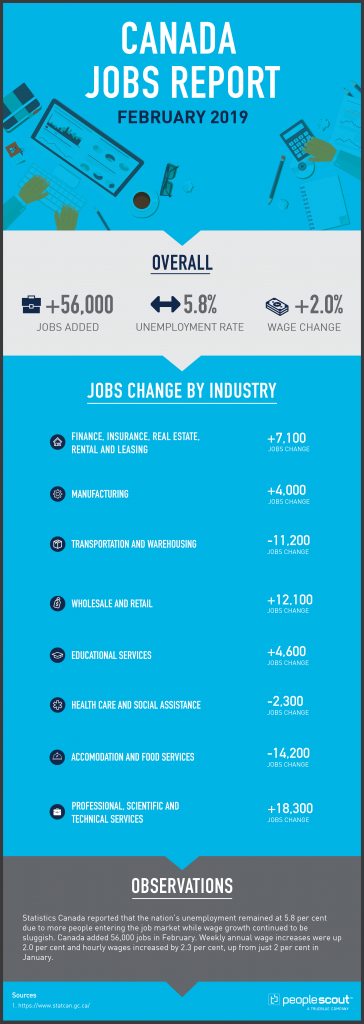

In contrast to its North American neighbor, Canada’s employment situation was mixed. The first quarter ended with an unemployment rate of 5.8%, but after two strong months of job gains, Canada lost jobs in March.

In Europe, many leading economies posted strong job gains and low unemployment. In the UK, the March Labour Market Report showed that a greater percentage of people in the UK were working than at any time since comparable records were kept. As a result, the unemployment rate in the UK plunged to 3.9%, the lowest rate since 1975. For other major European economies, the unemployment situation was mixed. The Eurozone’s unemployment rate was 7.8%, slightly lower than at the end of 2018. France posted an unemployment rate of 8.8% during the quarter while Germany recorded its unemployment at a very low rate of 3.3%.

In the Asia-Pacific region, unemployment continued to be negligible in the leading Asian economies. During the first quarter, China reported an unemployment rate of 3.8%, Japan was at 2.3%, Hong Kong at 2.8% and South Korea at 4.7%. India’s unemployment rate of 6.7% was slightly higher than a year earlier.

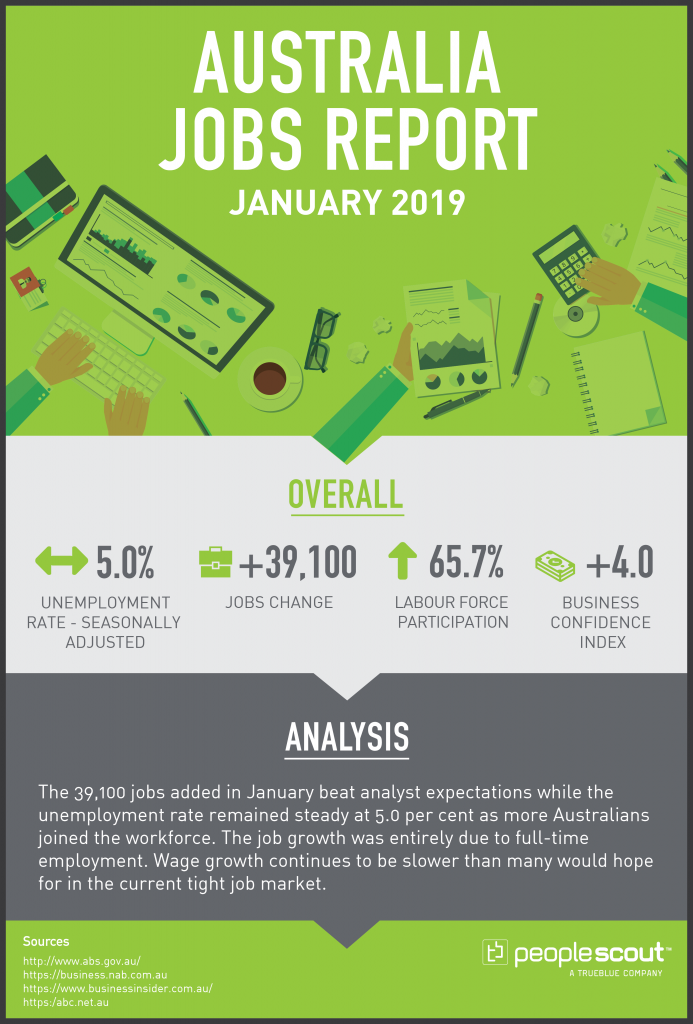

Other APAC economies posted strong employment numbers. Australian unemployment fell to 4.9%, the lowest level in eight years, and New Zealand reported that the unemployment rate had risen to 4.3% in the final quarter of last year.

Low unemployment has led employers to compete for a diminishing pool of available talent and has made it even more necessary to retain workers who may be lured by competitors offering higher wages and other incentives.

Wages Rising but Inflation Remains Low

The conventional wisdom holds that wages rise when the supply of workers is low. Yet, wage increases have grown very gradually even in economies with very low unemployment. One of the reasons for this is that inflation rates in many advanced economies are quite low, so even modest wage increases can have a positive impact on a household’s ability to spend and save. In some economies, wages began to rise significantly in 2018 and continued in 2019. In the U.S., annual wage increases rose to 3.4% in February before contracting slightly to 3.2% in March. Coupled with an inflation rate of just 1.5%, wage increases in the U.S. are growing more than two times as much as the price of goods and services. In the UK, the annual wage increase of 3.4% was still well above the inflation rate of 1.9%

In two other major economies, the wage growth picture is not as positive. Canada was posting year-over-year wage growth of more than 3% in mid-2018, but by March 2019 the average year-over-year wage growth for permanent employees was just 2.3%. While Canada’s inflation rate was 1.5%, the same as the U.S., Canadian workers benefited less than their U.S. counterparts from their wage increases.

In Australia, wage growth was just 2.3% in 2018 and some estimate that Australians are experiencing their lowest increase in pay since World War II. With inflation running at 1.8%, workers are still coming out ahead, but not as much as in the U.S. or UK. The reasons for the difference in wage growth among these four Anglosphere economies are rooted in the structures of the individual economies. Slow wage growth has contributed to low inflation in each country, but as wages rise, so does the possibility of an increase in inflation. If inflation increases, there would be even greater incentive for workers to change jobs to increase their income and for employers to respond by offering higher wages.

High Anxiety – Trade and Jobs

In North America, NAFTA, the agreement which has tied the economies of Canada, the United States and Mexico, was set to be replaced by the new USMCA treaty. The treaty was signed by the heads of all three countries late last year but it has not yet been ratified by any of their respective legislatures. The uncertainty due to the lack of clear tariff regimes in the near future may cause considerable disruption in different sectors in each economy. In the U.S., manufacturing, a sector which may be most impacted by North American trade, lost jobs in March for the first time since 2017.

But any concerns in North America pale in comparison to anxiety over Brexit. As of the time of publication, the UK is set to leave the European Union on October 31, 2019. There remains a possibility that the UK will exit the EU without any agreement and possibly experience economic chaos.

If and when Brexit occurs, it has already had an impact on the UK workforce, especially in the area of foreign workers. The Guardian reports:

“There were an estimated 2.33 million workers from the EU27 in the UK between October to December in 2017, but that figure dropped to 2.27 million a year later. A notable drop in workers from A8 countries, which joined the bloc in 2004 and include Poland and the Czech Republic, largely accounted for the decrease. It contrasted with an increase in the number of non-EU workers in the UK, rising from 1.16 million to 1.29 million in the same period. This was an increase of 130,000 compared with the equivalent period 12 months earlier, and the highest number since records began in 1997.”

The Guardian

Given the importance of workers from the EU in sectors such as healthcare, hospitality and meatpacking, a continued exodus of workers from the EU will have a major impact on key UK industries.

With so much concern over the economic future, why have the job numbers in the UK been so positive? While it may simply be a matter of filling the demand employers have for talent, Bloomberg suggests a more somber reason:

“One explanation for the resilience of the labor market is that firms are hiring workers rather than spending on capital equipment because employment decisions are easier to reverse in a downturn.”

Bloomberg

In other words, newly hired workers are more expendable in an economic downturn than capital equipment, a sobering thought for both employers and workers during these uncertain times.