In the current economy, contingent workers are an integral and growing part of the workforce. Whether freelancers, consultants or contract workers, contingent labor of all skillsets is in high demand. For many organizations, contingent workers are the fastest and most effective way to augment their current workforce and respond to rising talent demands, staff large strategic projects, add new skills and expertise and accelerate growth.

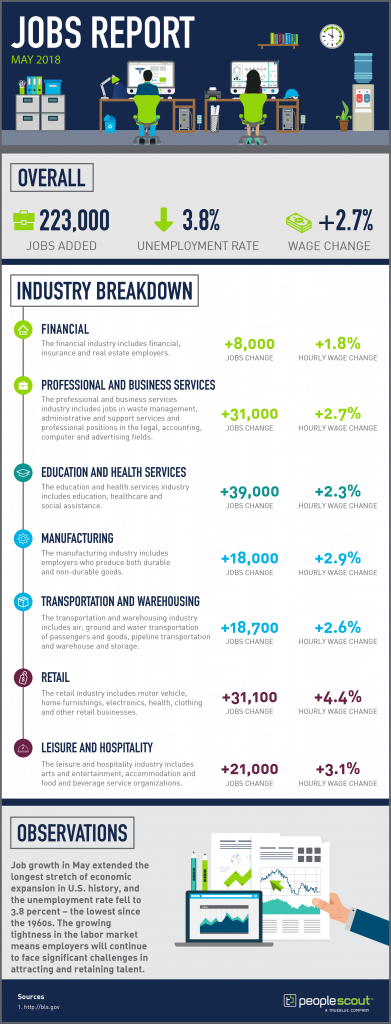

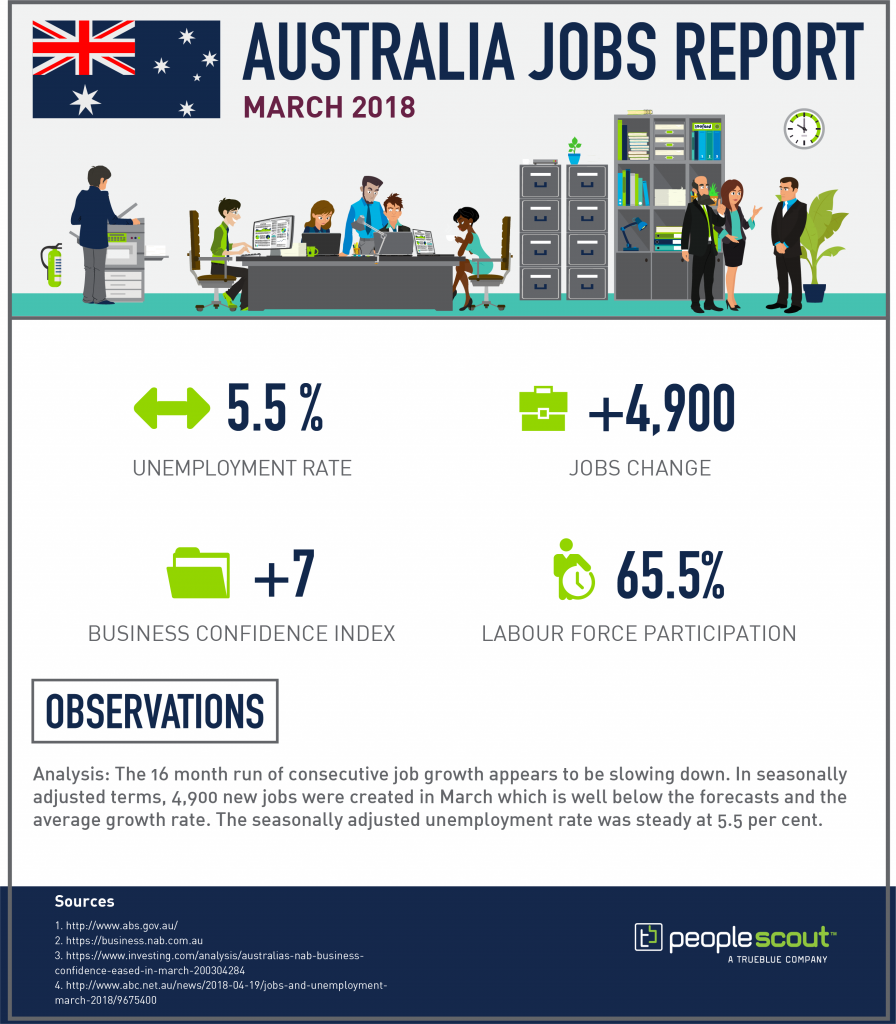

Contingent labor by the numbers:

In this post, we examine the current contingent workforce landscape, the trends shaping how organizations engage contingent labor and the evolving role of MSP providers.

The New Role of Managed Service Providers in Contingent Workforce Management

The role of the Managed Service Provider (MSP) has evolved. According to NelsonHall’s Next Generation Managed Services Programs, MSPs are an increasingly influential and strategic partner in helping organizations better manage their contingent workforces. MSPs provide consultative, data-based insights to clients. From contingent workforce spend and talent channels to supplier performance, the data and analysis provided by an MSP is hugely valuable for organizations as they embrace a more contingent workforce model.

MSPs provide organizations with contingent workforce data, training, and overall strategy. Organizations have continued to use MSP providers that have developed the infrastructure to align suppliers, improve productivity, provide administration and program management and, most importantly, reduce costs of managing contingent labor. Not only are decreased costs a benefit, but MSPs also enable organizations to have direct access to talent.

Total Workforce Solutions

With the growing trend of blended workforces leveraging full-time, part-time, statement of work (SOW) projects and contingent labor, there is a demand to integrate MSP and RPO solutions into one talent management program. Total Workforce Solutions (TWS) allow organizations to streamline talent acquisition for all categories of labor by blending the benefits of RPO with an MSP.

TWS solutions can help organizations source full-time, temporary, statement of work, professional services or 1099 workers to meet hiring needs based on an organization’s business objectives. Integrating RPO and MSP talent management into one program provides organizations with a competitive edge when it comes to understanding their talent needs and their ability to fulfill them.

Freelancing as a Career

With the economy in constant flux it is imperative that businesses remain responsive to change. Organizations are increasingly deciding that it is more advantageous to deploy a more elastic workforce, one that can quickly contract in bad economic times or expand during periods of growth. Workers too are adapting to current economic realities. Based on projected current workforce growth rates, the majority of U.S. workers may be freelancers by the year 2027. Millennials — the largest and generation in the workforce — are spearheading the rise in freelancing, with nearly half of all millennials currently working as freelancers.

Millennials were raised in a digital age, and, as a result, expect to have access to a variety of modern tools and new innovations. Because millennials have been consistently exposed to a consumerized and “on-demand” world, engaging these younger professionals requires a varied set of strategies from social media engagement to sourcing talent on freelancer forums.

Millennials are not the only demographic turning to contingent labor as a career option. According to a study published by the Freelancers Union and Upwork, baby boomers are the generation that’s most likely to make the choice to start freelancing. What’s more, according to the Employee Benefit Research Institute, a significant portion of those reaching retirement age are choosing to remain in the workforce. Twenty-six percent of workers plan to work until age 70, and another 6 percent say they will never want to retire.

When recruiting baby boomers for contingent work, organizations should keep in mind that this generation has different goals than their younger counterparts. Baby boomers and workers beyond retirement age interested in contingent work are likely looking for a way to stay active, socialize and receive recognition for their skills and abilities. So, when engaging baby boomer candidates, organizations should position contingent job opportunities as chances to remain productive but independent.

Recruitment Marketing and Employer Branding

To attract contingent workers, organizations are turning to innovative recruitment marketing tactics. According to research conducted by Aberdeen Group, best-in-class organizations are twice as likely to use recruitment marketing within their talent acquisition function for employees of all classifications.

To reach the best candidates, organizations need to reach out to them where they are. Pew Research has found that 41 percent of adults have used a smartphone at some point in their job search. Organizations looking to recruit contingent workers should create mobile-first application experiences. Content and information should be repurposed from desktop websites to fit the mobile-first design of smart phones and apps.

Organizations should also be mindful of employer branding, as candidates now have more power than ever to affect an organization’s reputation. According to a study conducted by Glassdoor, 70 percent of job seekers consulted the site during their job search. Negative reviews by current and former employees are likely to turn away contingent talent who may have more options when it comes to selecting an employer. Organizations should check job boards and review sites to see what employees have to say about working for them, and address common issues and complaints to improve their employer brand.

The Evolution of Contingent Labor Technology

Vendor Management Systems (VMS) have been around for quite some time, helping organizations better manage the complexities of the contingent workforce. Leveraging the reporting capabilities of VMS software has become more widely adopted as standard practice. What’s more, with advances in VMS software—namely robotic process automation—organizations can more accurately track workers, hours and pay rates and analyze supplier performance, all key components of accurate contingent labor reporting. The speed and accuracy of automated reporting functions allow organizations to make more decisive decisions in real-time with up-to-date data.

MSP providers are also offering new technology to supplement legacy VMS platforms. According to NelsonHall’s study, Changing Shape of Managed Service Programs, approximately 75 percent of MSP vendors either offer Freelance Management Systems (FMS) technology in addition to VMS platforms, or are currently looking to introduce FMS technology in the future. This shift is driven by the need to manage an increasing number of independent contractors and freelancers in the market. FMS technology is newer and better able to process freelancer information (in addition to other contingent workers), compared with VMS technology.

Organizations and MSP providers are not the only ones benefiting from advances in contingent labor technology. New online services make it easier for independent contractors to find and sustain contingent work. Mobile apps like JobStack by PeopleReady and other online freelance marketplaces are growing more popular in the gig economy. They allow organizations to effectively direct source candidates and quickly fill staffing gaps as one piece of an MSP program.

Direct Sourcing is Growing Among Organizations

A study conducted by the Oxford Internet Institute at the University of Oxford notes that from 2016 to 2017, there was a 26 percent increase in the work that organizations source from platforms such as Freelancer, Upwork, PeoplePerHour and Crowdstaffing Inc. This trend indicates that more and more organizations are internalizing their search for contingent workers. Even more, the social environment created by these contingent networking opportunities allow the workers themselves to inquire with organizations about opportunities. Below we list benefits and challenges of directly sourcing contingent labor.

Benefits of direct sourcing:

- The ability to re-engage proven talent over the long-term rather than one engagement.

- Organizations can gain better data and visibility with metrics and results being tracked in-house.

- Cost savings from fewer supplier fees and less overhead.

Challenges of direct sourcing:

- Ensuring in-house program management practices are built to include direct sourcing processes. This will be a challenge because these practices could be different from currently established processes that are applied to third-party suppliers.

- Managing and keeping track of multiple sourcing channels.

- Securing buy-in from internal stakeholders who do not understand the benefits of direct sourcing or are unconvinced of its benefits.

Conclusion:

PeopleScout’s MSP programs combine expertise in staffing and supplier management with leading VMS technology to best meet an organization’s business requirements. Each solution offered by PeopleScout is customized to provide the best talent, seamless implementation, strong governance and compliance, comprehensive program management, high touch customer care, value-add services and tangible savings – with a goal of creating operational excellence and yielding sustainable value. Click here to learn more about PeopleScout’s award-winning MSP solutions.