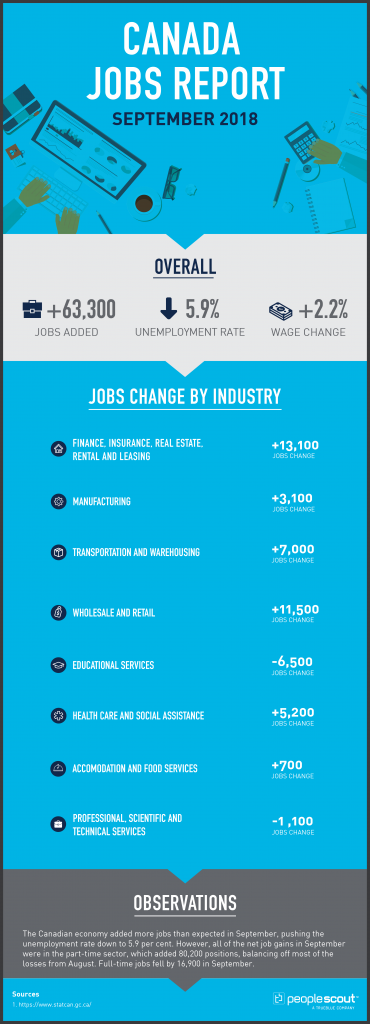

Canada’s unemployment rate has moved back down to a four-decade low of 5.8 per cent, but even in a tight job market where employers are having a hard time finding workers, wage growth is slowing. The nation added 11,200 net new jobs in October, including a gain of 33,900 full-time positions, Statistics Canada reported in its latest labour force survey. The agency said the jobless rate moved down from the 5.9 per cent level in September, mainly because fewer people searched for work.

The Numbers

11,200: The economy gained 11,200 jobs in October.

5.8%: The unemployment rate fell to 5.8 per cent.

1.8%: Weekly wages decreased to 1.8 per cent over the last year.

The Good

Employment among people in the core-aged group (25 to 54) rose by 31,000 in October. On a year-over-year basis, employment for core-aged workers increased by 169,000 (+1.4 per cent) with gains equally distributed between men and women. Job gains were not limited to the core age group. The number of workers aged 55 and over rose by 19,000 in October, which is the result of more employed women in this age category. The unemployment rate for all workers aged 55 and over fell by 0.3 percentage points to 4.9 per cent. Compared with October 2017, the number of workers aged 55 and over increased by 72,000 (+1.8 per cent).

More Canadians were employed in business, building and other support services; wholesale and retail trade; and healthcare and social assistance. Full-time employment rose by nearly 34,000. Over the last year, the number of employed people in Canada grew by206,000 or 1.1 per cent, with the most of the gain coming from full-time work (+173,000).

The Bad

Year-over-year, average weekly wage growth fell to just 1.8 per cent and hourly wage growth slowed last month to 2.19 per cent for the lowest reading level September 2017. Experts have predicted wage growth to rise along with a tightened labour market, but average hourly wage growth has dropped every month since May when it was 3.94 per cent.

The loss of over 22,000 part-time jobs contributed to the lackluster job gains in October. The unemployment rate fell only because fewer people were in the labour force which decreased by 18,200. With the exception of Saskatchewan which gained 2,500 jobs in October, employment was essentially flat in every other province.

There were 17,000 fewer Canadians working in “other services” in October, the first notable decline in six months. “Other services” includes services such as those related to civic and professional organizations; repair and maintenance; and private households. Employment in finance, insurance, real estate, rental and leasing declined by 15,000 in October, offsetting an increase the month before. On a year-over-year basis, employment in the industry was essentially unchanged.

The Unknown

The tax reforms in the U.S. may seriously impact the Canadian economy in the near future according to a recent PwC study as reported in BNN Bloomberg:

“Our analysis suggests that the U.S. tax reform has eliminated one of Canada’s main competitive advantages. We are of the view that this loss will have a significant negative impact on capital-intensive sectors in Canada,” according to the report, which was produced for the Business Council of Canada. “All else being equal, these sectors as a whole would likely face a significant shift in investments from Canada to the U.S. over the next 10 years.”

The wide-ranging tax reform bill cut the U.S. corporate tax rate to 21 per cent from 35 per cent and allows for companies to deduct the full cost of capital spending from their tax bills.

PwC said $85-billion in GDP – about 4.9 per cent of total output – and 635,000 jobs are at risk due to the U.S. leapfrogging Canada on the competitive front. It forecasts the chemical, machinery manufacturing and plastics industries would be most at risk. On a provincial basis, PwC said Ontario has the most on the line, accounting for nearly one out of every three dollars identified at risk.”