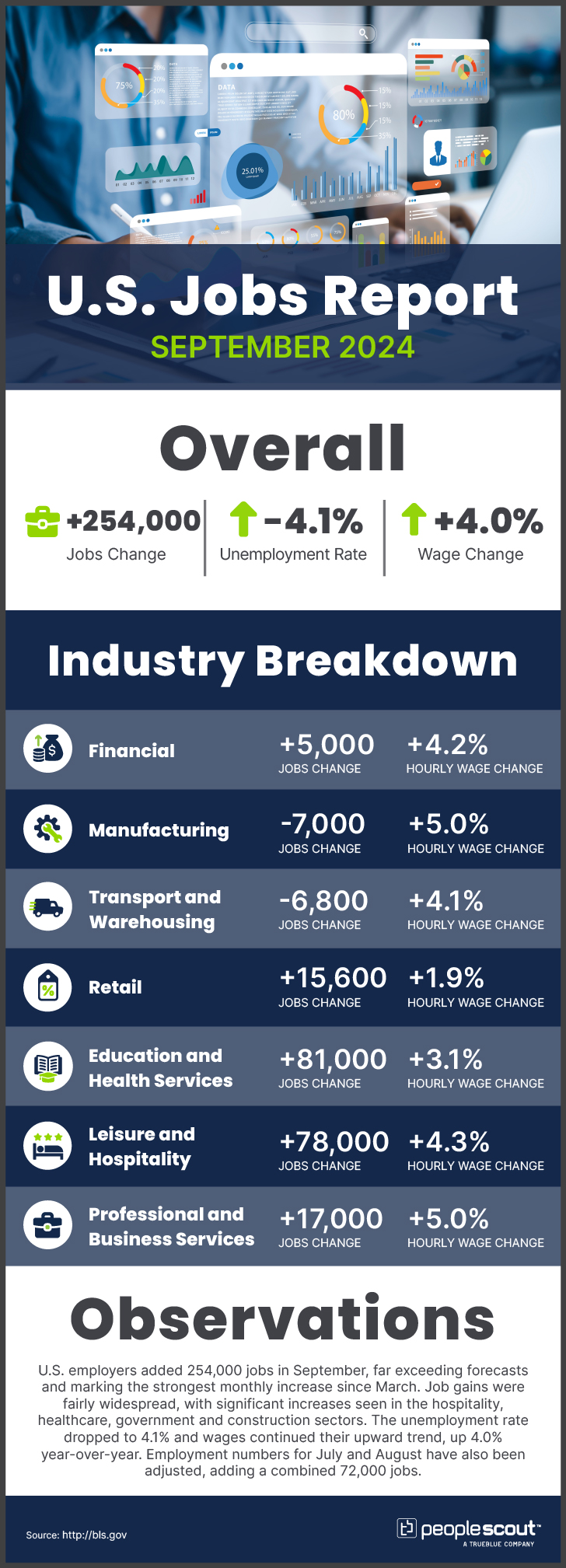

U.S. employers added 254,000 jobs in September, far exceeding forecasts and marking the strongest monthly increase since March. Job gains were fairly widespread, with significant increases seen in the hospitality, healthcare, government and construction sectors. The unemployment rate dropped to 4.1% and wages continued their upward trend, up 4.0% year-over-year. Employment numbers for July and August have also been adjusted, adding a combined 72,000 jobs.

The Numbers

254,000: U.S. employers added 254,000 jobs in August.

4.1%: The unemployment fell to 4.1%.

4.0%: Wages rose 4.0% over the past year.

The Good

The U.S. labor market showed remarkable strength in September, with 254,000 jobs added, far surpassing forecasts and marking the strongest monthly gain since March. The unemployment rate dipped to 4.1%, and wage growth remained strong at 4% year-over-year. Job gains were widespread across sectors—including Leisure and Hospitality, Healthcare and Construction—suggesting broad-based economic strength. Other signals of a resilient job market include an adjusted 72,000 additional jobs in July and August, and another labor force participation rate increase to 60.2%.

The Bad

While the report was overwhelmingly positive, some potential concerns remain. Though most industries saw growth, a few experienced declines—Manufacturing was down 7,000 jobs and Transportation and Warehousing jobs declined by 6,800. The strong job market and wage growth could potentially reignite inflationary pressures, complicating the Federal Reserve’s efforts to achieve a soft landing. The robust report might also delay or slow the pace of additional interest rate cuts, which could impact other areas of the economy such as housing and business investment.

The Unknown

The sustainability of this strong job growth in the face of high interest rates remains uncertain as the Federal Reserve continues its fight against inflation while supporting continued economic growth. While the strong September jobs report might reduce the urgency for aggressive rate cuts, the Fed will need to carefully consider other economic indicators, such as inflation data and consumer spending, to determine the appropriate pace of future rate cuts. Further, the impact of recent events, such as Hurricane Helene and the Boeing strike, on future job reports is yet to be seen.

Conclusion

September’s jobs report paints a picture of a remarkably resilient U.S. labor market, defying expectations of a slowdown. The robust job growth, declining unemployment rate and solid wage gains suggest that the economy is handling high interest rates better than anticipated. However, this strength presents a complex scenario for the Federal Reserve as it balances its goal of a soft landing with the need to keep inflation in check. While the report is undoubtedly positive for workers and households, it may lead to a more cautious approach to interest rate cuts.