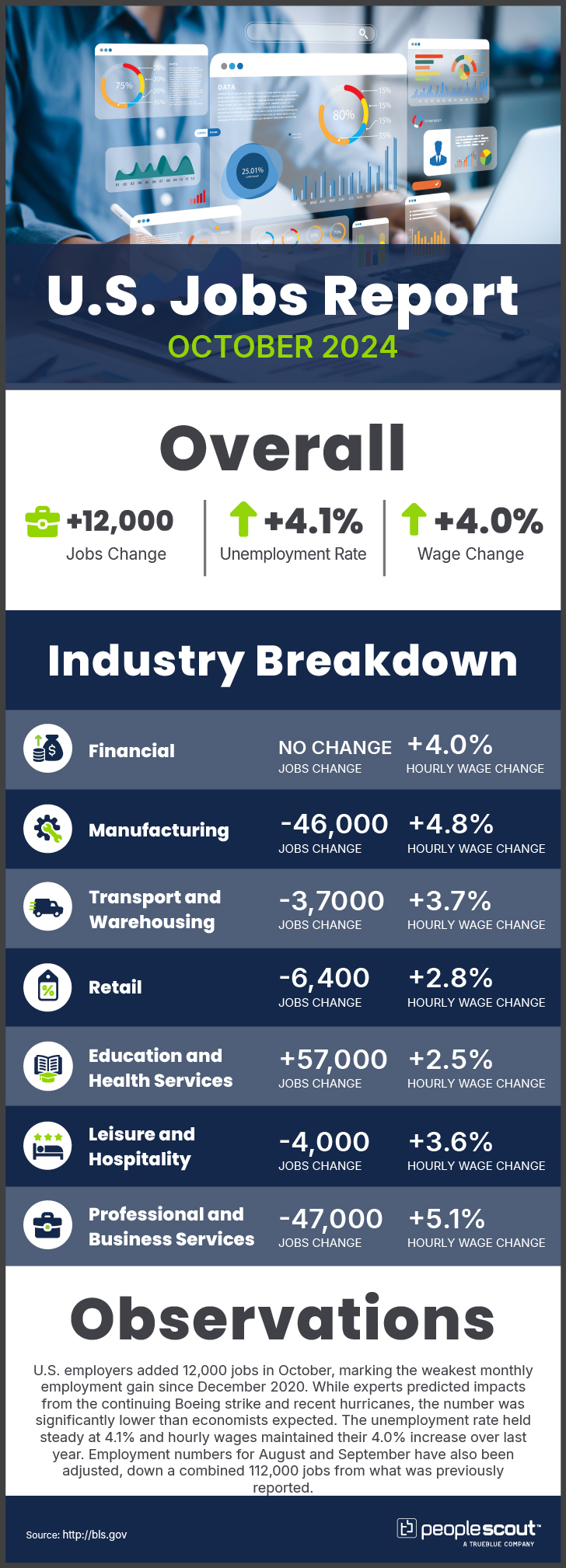

U.S. employers added 12,000 jobs in October, marking the weakest monthly employment gain since December 2020. While experts predicted impacts from the continuing Boeing strike and recent hurricanes, the number was significantly lower than economists expected. The unemployment rate held steady at 4.1% and hourly wages maintained their 4.0% increase over last year. Employment numbers for August and September have also been adjusted, down a combined 112,000 jobs from what was previously reported.

The Numbers

12,000: U.S. employers added 12,000 jobs in October.

4.1%: The unemployment rate held steady at 4.1%.

4.0%: Wages rose 4.0% over the past year.

The Good

While the headline jobs number for October was disappointing, coming in far below expectations, there were still some bright spots in the report. The unemployment rate held steady at a historically low 4.1%, suggesting overall labor market stability. Additionally, average hourly earnings continued to grow 4.0% year-over-year, outpacing inflation and indicating that wage pressures remain strong despite the slowdown in hiring. The healthcare sector showed continued strength, adding 52,000 jobs.

The Bad

Economists forecasted a slowdown in October, due largely in part to business disruption and job losses caused by recent hurricanes and the ongoing Boeing strike—however, this significant miss of expectations caught many economists by surprise. The 12,000 jobs added in October represented a sharp deceleration, and downward revisions to August and September’s gains were revised downward by a combined 112,000 jobs, suggesting a potential underlying cooling in the labor market.

The Unknown

The extent to which the October report reflects temporary disruptions versus a broader economic slowdown remains unclear. The Federal Reserve will be closely watching the data as it determines the appropriate pace of future interest rate cuts. While the October report may not significantly alter the Fed’s immediate policy path, with a quarter-point cut widely expected at the upcoming November meeting, the outlook for the path of rate cuts beyond that is less certain. Much will depend on how the labor market and other economic indicators evolve in the coming months.

Conclusion

The October 2024 jobs report paints a mixed picture of the U.S. labor market. The headline number of just 12,000 new jobs was disappointing, but the underlying fundamentals— such as the steady unemployment rate and strong wage growth—suggest the economy is still on relatively solid footing. However, the downward revisions to prior months’ data and the sharp declines in specific sectors raise concerns about potential weakening in the broader job market. The Federal Reserve will have to weigh this nuanced data as it determines the appropriate course in the months ahead.