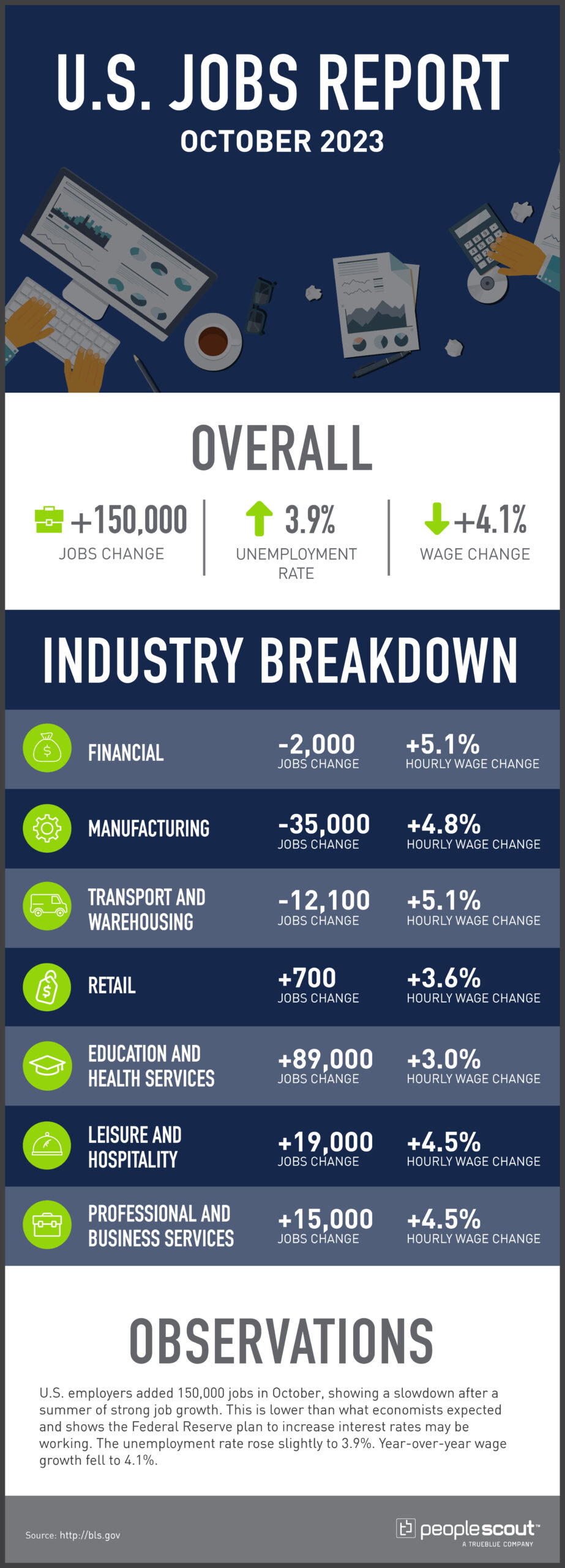

U.S. employers added 150,000 jobs in October, showing a slowdown after a summer of strong job growth. This is lower than what economists expected and shows the Federal Reserve plan to increase interest rates may be working. The unemployment rate rose slightly to 3.9%. Year-over-year wage growth fell to 4.1%.

The Numbers

150,000: U.S. employers added 150,000 jobs in October.

3.9%: The unemployment rate fell to 3.9%.

4.1%: Wages rose 4.1% over the past year.

The Good

According to the Wall Street Journal, October’s report is the clearest sign we’ve seen that the Federal Reserve strategy of raising interest rates to slow the job market and control inflation may be working. Throughout the summer, job growth remained strong, consistently outperforming analyst expectations. The latest numbers fall into a more sustainable rate of growth. Additionally, wage growth appears to be slowing. Over the past 12 months, year-over-year wage growth has been as high as 4.8%, which makes October’s 4.1% encouraging.

The Bad

While the U.S. saw overall job growth, several industries contracted last month. Some of the most significant losses were in the manufacturing, transportation and warehousing sectors. Although, as the New York Times reported, some of this can be explained by ongoing strikes, particularly in the auto industry. Another concerning sign is that labor force participation decreased in October, shrinking the labor force by 201,000 people. Though experts say not to read too much into monthly fluctuations, they will watch the labor force participation rate in the coming months.

The Unknown

With September’s blockbuster jobs report and October’s slowdown, MarketWatch reports that the U.S. economy is displaying mixed signals, but evidence is mounting that a cooldown is starting. However, experts debate exactly how it will continue to play out. Some say the economy could continue to move forward without any major bumps, just at a slower pace; while others say they’re more concerned. They tend to agree, though, that the latest report makes it less likely that the Federal Reserve will decide to raise rates again at the next meeting in December.