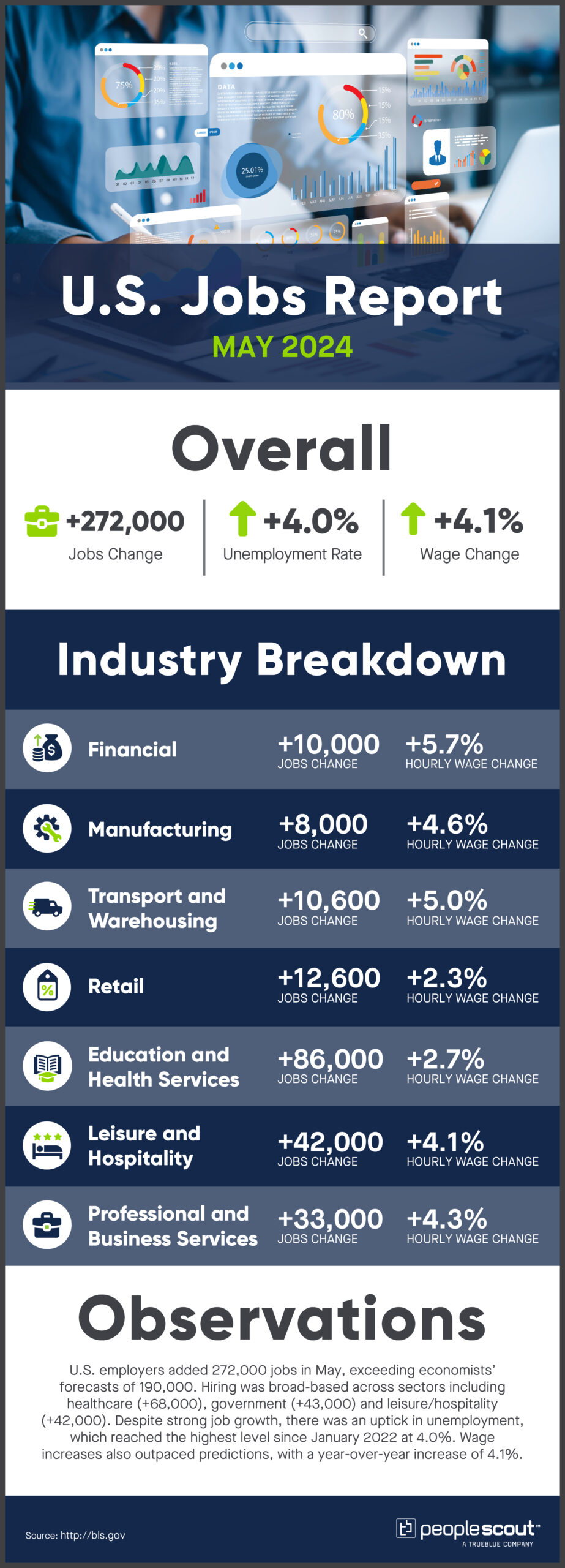

U.S. employers added 272,000 jobs in May, exceeding economists’ forecasts of 190,000. Hiring was broad-based across sectors including healthcare (+68,000), government (+43,000) and leisure/hospitality (+42,000). Despite strong job growth, there was an uptick in unemployment, which reached the highest level since January 2022 at 4.0%. Wage increases also outpaced predictions, with a year-over-year increase of 4.1%.

The Numbers

272,000: U.S. employers added 272,000 jobs in May.

4.0%: The unemployment rate rose to 4.0%.

4.1%: Wages rose 4.1% over the past year.

The Good

May’s job growth significantly outpaced expectations, with payrolls expanding by 272,000 compared to the 190,000 forecasted by economists. Hiring was broad-based across sectors like healthcare (+68,000), government (+43,000), leisure/hospitality (+42,000), professional services (+33,000), and even rate-sensitive areas like construction and manufacturing. The report signals the resilience of the labor market despite the Fed’s aggressive interest rate hikes over the past year to combat inflation. Wage growth also accelerated, with average hourly earnings up 4.1% year-over-year. For American workers, the recent stretch of sturdy job and income growth provides reassurance amid persistent inflation pressures, and according to the Wall Street Journal, most economists remain optimistic about the near-term outlook.

The Bad

In an otherwise stellar report, the one potential red flag was the uptick in the unemployment rate to 4.0%—the highest level since January 2022. As seen in previous months, the increase was driven both by some workers losing their jobs as well as more individuals entering the labor force. However, listed job openings have declined faster than economists anticipated. The higher unemployment rate might indicate the Fed’s rate hikes are starting to have more of a cooling effect on the jobs market. Global chief strategist at Principal Asset Management, Seema Shah, told CNBC the May jobs report was “one step forward, two steps back”. Citing that not only has job growth exploded, but wages have also increased, both the opposite of what the Fed wants to see before cutting rates.

The Unknown

As stated by New York Times economic reporter Ben Casselman, “Sometimes, the many numbers included in the government’s monthly jobs report come together to paint a clear, coherent picture of the strength or weakness of the U.S. labor market. This is not one of those times.” The key question is what impact, if any, this report will have on the Federal Reserve’s deliberations around potential interest rate cuts later this year. If hot hiring and wages persist, it will likely force the Fed to leave its benchmark rate higher for longer to help restrain inflation. Conversely, if momentum begins fading in the months ahead, it could open the door to rate cuts by year-end. Before the release of the May report, markets had priced in over a 50% chance of a rate cut by September. However, the combination of robust hiring, accelerating wage growth and a higher unemployment rate muddy the outlook.

Conclusion

May’s jobs report delivered a counterintuitive picture of a red-hot labor market at a time when the Federal Reserve has been attempting to put on the brakes. The combination of soaring payrolls and revived wage pressures suggests demand for labor has yet to be tamed, even as overall economic growth is expected to downshift. However, the mixed signals in the data have left investors and economists alike scratching their heads over the Fed’s next policy moves. With their dual mandate of price stability and maximum employment, policymakers will be watching closely to determine if this job market strength is sustainable or if a more pronounced cooling is ahead.