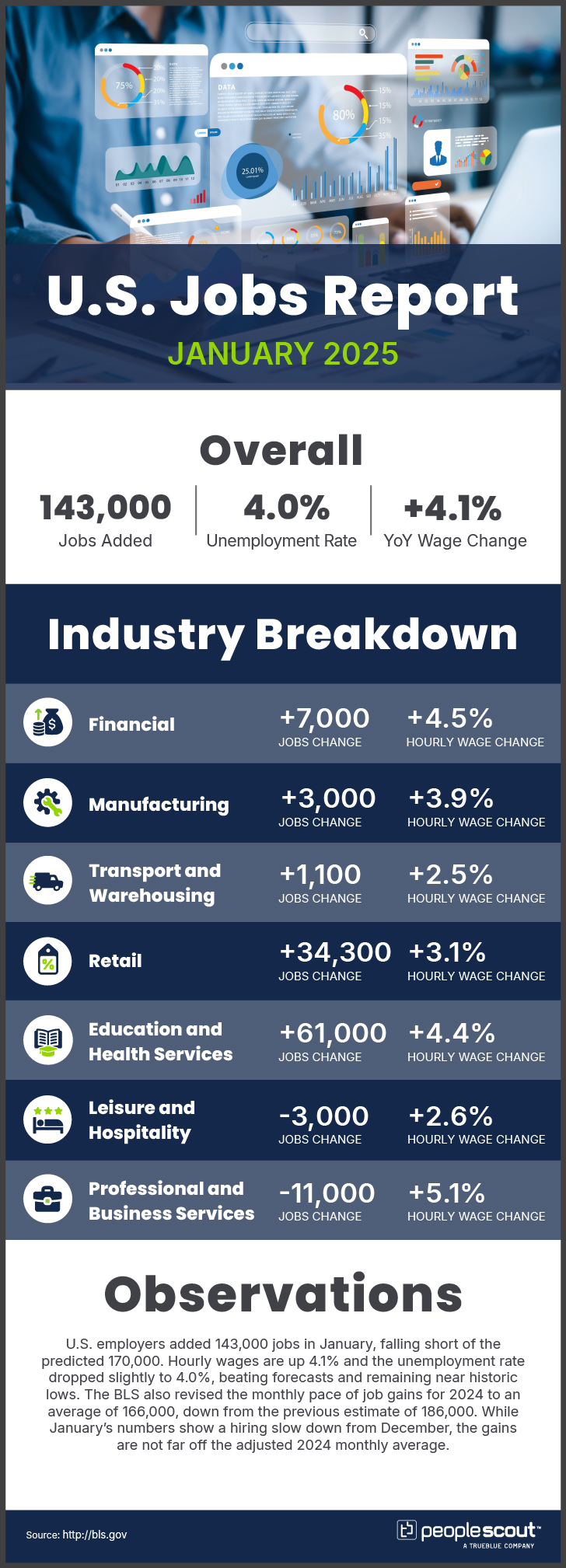

U.S. employers added 143,000 jobs in January, falling short of the predicted 170,000. Hourly wages are up 4.1% and the unemployment rate dropped slightly to 4.0%, beating forecasts and remaining near historic lows. The BLS also revised the monthly pace of job gains for 2024 to an average of 166,000, down from the previous estimate of 186,000. While January’s numbers show a hiring slow down from December, the gains are not far off the adjusted 2024 monthly average.

The Numbers

- 143,000: U.S. employers added 143,000 jobs in January.

- 4.0%: The unemployment rate edged down to 4.0%.

- 4.1%: Wages rose 4.1 % over the past year.

The Good

The U.S. labor market kicked off 2025 with modest job growth, adding 143,000 jobs in January. While this fell short of economists’ expectations, the unemployment rate edged down to 4.0%, marking its lowest level since May 2024, and wage growth remained strong. Job gains were concentrated in familiar strongholds: Healthcare (+44,000), Retail (+34,000) and Government (+32,000), continuing trends from late 2024. Additionally, the labor force participation rate for prime-age workers (25-54) ticked up to 83.5%, driven by increased male participation.

The Bad

January’s jobs report suggests that the labor market may be losing momentum. The 143,000 jobs added represent a notable step down from December’s upwardly revised 307,000 gain. Moreover, annual revisions to 2024 data revealed that job growth was weaker than initially estimated, with the Labor Department revising down its job count by 589,000 for the 12 months ending in March 2024. Mining and oil and gas extraction lost 8,000 jobs, and hiring remains sluggish across several industries outside of Healthcare, Social Assistance and Government. Despite strong wage growth, broader labor market churn remains low, suggesting that businesses are proceeding with hiring decisions cautiously.

The Unknown

This report leaves several key questions unanswered. While the slowdown in job creation may indicate a cooling labor market, strong wage growth and a historically low unemployment rate suggest resilience. How will the Federal Reserve interpret these mixed signals? With their next meeting in March, there’s still time for additional data—including another jobs report and inflation readings—to shape its decision on interest rates. Investors have been anticipating potential rate cuts in the first half of the year, but January’s wage gains could lead the Fed to take a wait-and-see approach. Additionally, new administration policies—including proposed cuts to federal payrolls and immigration restrictions—could significantly reshape labor market dynamics in the months ahead.

Conclusion

The January 2025 jobs report suggests a labor market that is stable but slowing. While job growth remains positive, the pace has decelerated, and downward revisions to prior months highlight a weaker hiring environment than previously believed. Still, with unemployment at just 4.0% and wages continuing to rise, the labor market remains strong by historical standards. The market appears to be transitioning from post-pandemic dynamics to a more measured growth pattern, though policy uncertainties could significantly impact this trajectory in the months ahead.