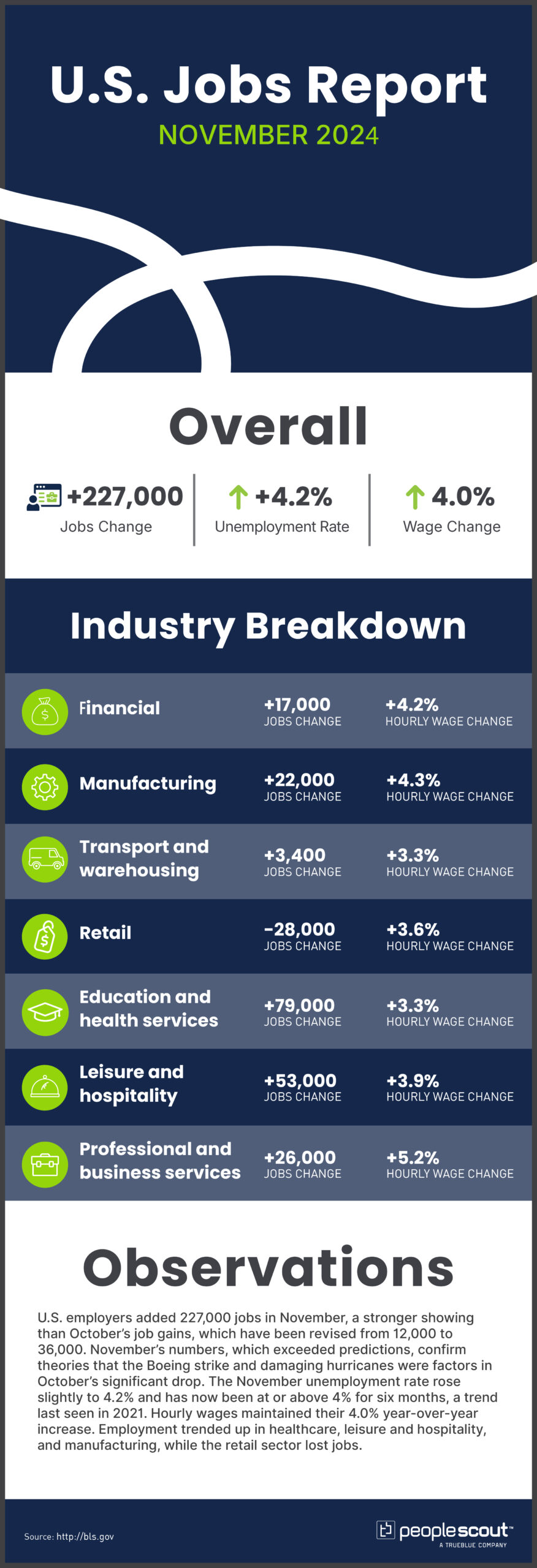

U.S. employers added 227,000 jobs in November, a stronger showing than October’s job gains, which have been revised from 12,000 to 36,000. November’s numbers, which exceeded predictions, confirm theories that the Boeing strike and damaging hurricanes were factors in October’s significant drop. The November unemployment rate rose slightly to 4.2% and has now been at or above 4% for six months, a trend last seen in 2021. Hourly wages maintained their 4.0% year-over-year increase. Employment trended up in healthcare, leisure and hospitality, and manufacturing, while the retail sector lost jobs.

The Numbers

227,000: U.S. employers added 227,000 jobs in September.

4.2%: The unemployment rate rose slightly to 4.2%.

4.0%: Wages rose 4.0% over the past year.

The Good

November brought a welcome rebound in job creation, with the U.S. economy adding 227,000 jobs, in line with economists’ expectations and indicating a recovery from the storm- and strike-distorted figures in October. Gains were particularly strong in healthcare (+54,000) and leisure and hospitality (+53,000), reflecting the resilience of these sectors amid broader economic shifts. Manufacturing also saw a boost of 32,000 jobs as striking Boeing employees returned to work. Wage growth remained strong, with average hourly earnings up 4% year-over-year.

The Bad

Despite strong job growth, there were some potential concerns in the November report. The unemployment rate ticked up from 4.1% to 4.2%, and long-term unemployment is rising, with jobseekers now taking an average of 23.7 weeks to find work—the longest duration since April 2022. The retail sector shed 28,000 jobs, which could indicate weakness in consumer spending or subdued holiday hiring. Additionally, the labor market’s momentum is cooling compared to earlier in the year. The three-month average gain of 173,000 jobs, while healthy, is below the pace seen during the pandemic rebound.

The Unknown

The November report highlights a labor market that is stable but slowing, raising questions about the sustainability of recent gains. The Federal Reserve will likely interpret the data as supportive of further interest rate cuts at its December meeting, but uncertainty remains. Persistent wage growth could keep inflation pressures alive, potentially complicating the Fed’s plans to slow or suspend rate cuts in the near term. The broader economic context, including potential shifts in fiscal policy and global economic conditions, will also play a critical role.

Conclusion

Once again, we’re seeing a nuanced view of the U.S. labor market. While the economy continues to add jobs and wages remain strong, there are subtle signs of cooling. The November report reinforces the narrative of a labor market in transition—moving from the extraordinary churn of the post-pandemic period to a more measured, stable state. The Federal Reserve will keep a close eye on multiple market indicators as it considers future monetary policy, balancing their goal of controlling inflation and maintaining economic growth. For workers and businesses alike, the message is one of cautious optimism: the job market remains resilient, but the easy gains of the post-pandemic recovery may be giving way to a more deliberate, measured expansion.