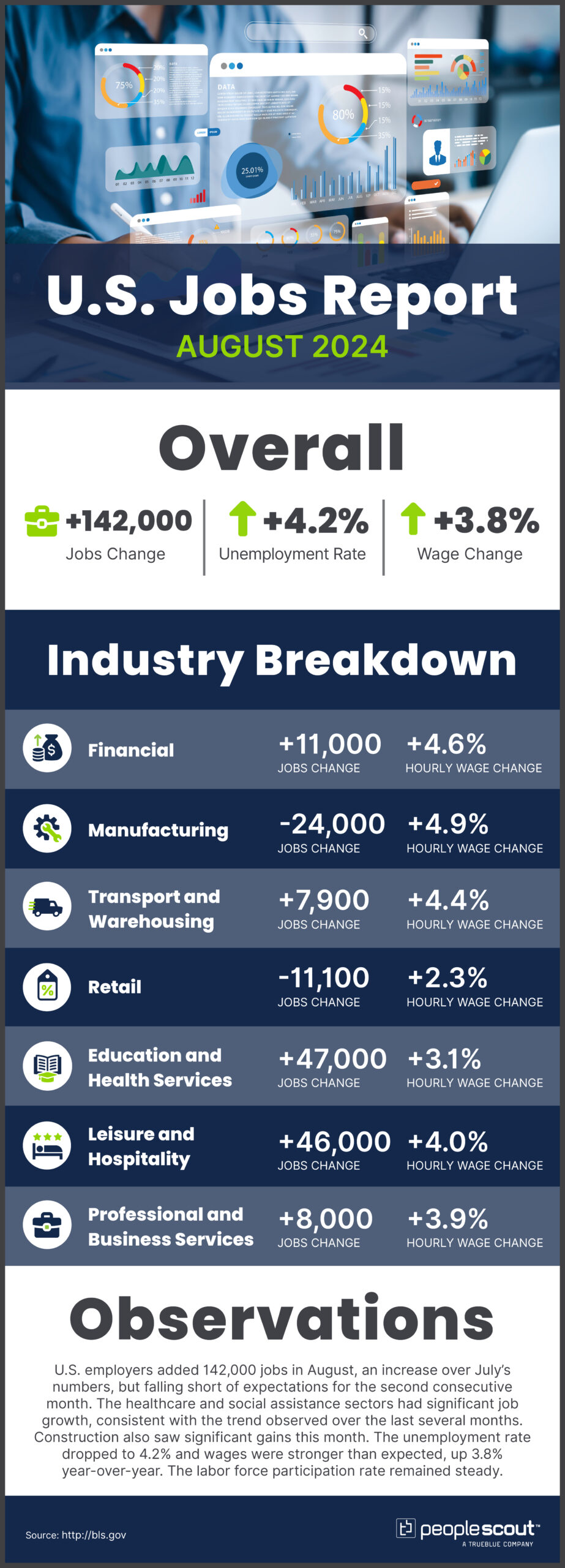

U.S. employers added 142,000 jobs in August, an increase over July’s numbers, but falling short of expectations for the second consecutive month. The healthcare and social assistance sectors had significant job growth, consistent with the trend observed over the last several months. Construction also saw significant gains this month. The unemployment rate dropped to 4.2% and wages were stronger than expected, up 3.8% year-over-year. The labor force participation rate remained steady.

The Numbers

114,000: U.S. employers added 142,000 jobs in August.

4.2%: The unemployment rate fell to 4.2%.

3.8%: Wages rose 3.8% over the past year.

The Good

U.S. job growth continues, albeit modestly. The 142,000 jobs added in August demonstrates continued resilience despite the Federal Reserve’s sustained interest rate hikes. Labor force participation also remains high at 83.9%, near July’s 84% which was the highest since 2001. Healthcare, social assistance and construction sectors showed resilience with significant job gains. Wage growth was stronger than expected, with average hourly earnings up 3.8% year-over-year, and unemployment dropped slightly to 4.2%.

The Bad

August job gains fell short of economists’ forecasts, and revisions to June and July data further underscore a cooling labor market. The combined June and July decrease of 86,000 jobs puts the three-month average at 116,000 job gains per month —significantly lower than last year’s average of 202,000 per month. Job losses in manufacturing and sluggish growth in other sectors highlight the uneven nature of the recovery and the impact of rising interest rates on certain industries. A broader measure of underemployment, which includes part-time workers who desire full-time work, increased to 7.9%, its highest level since October 2021.

The Unknown

All eyes are on the Fed’s next move. Although the August report suggests a cooling labor market, wage growth remains robust. While a rate cut in September seems likely, the size of the cut remains uncertain. The Federal Reserve has made it clear they will carefully weigh multiple economic factors in determining future interest rate cuts. It is unclear whether this jobs report indicates a temporary slowdown or the beginning of a more significant economic shift. The long-term effects of persistently high interest rates on business investment and hiring, and the sustainability of wage growth in the face of cooling market conditions have yet to be seen.

Conclusion

August’s jobs report presents a mixed picture of the U.S. labor market, with signs of both resilience and cooling. While job growth rebounded from July’s low, it still fell short of expectations, and significant downward revisions to previous months paint a picture of a more rapidly cooling labor market than initially thought. The drop in unemployment and strong wage growth are promising, but the narrowing of sector growth and increase in underemployment suggest underlying weaknesses. This report puts the Federal Reserve in a delicate position as it considers its next moves. While a rate cut in September seems likely, mixed economic signals may complicate the decision on the size of the cut.