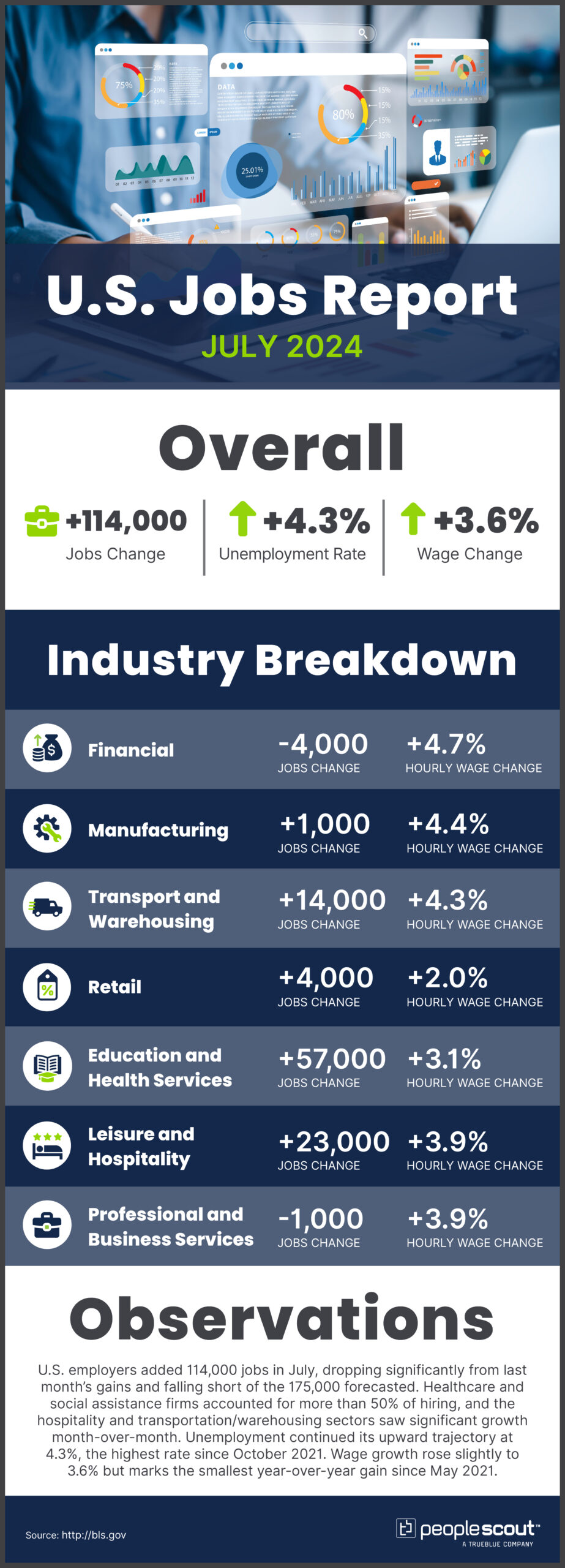

U.S. employers added 114,000 jobs in July, dropping significantly from last month’s gains and falling short of the 175,000 forecasted. Healthcare and social assistance firms accounted for more than 50% of hiring, and the hospitality and transportation/warehousing sectors saw significant growth month-over-month. Unemployment continued its upward trajectory at 4.3%, the highest rate since October 2021. Wage growth rose slightly to 3.6% but marks the smallest year-over-year gain since May 2021.

The Numbers

114,000: U.S. employers added 114,000 jobs in July.

4.3%: The unemployment rate rose to 4.3%.

3.6%: Wages rose 3.6% over the past year.

The Good

The economy continues to add jobs, marking the 43rd straight month of job growth. This resilience is notable given the Federal Reserve’s aggressive interest rate hikes over the past two years. Some sectors showed particular strength, with healthcare and social assistance firms adding 64,000 jobs, accounting for 56% of hiring. The leisure and hospitality sector also saw gains, adding nearly 26,000 jobs. The labor force participation rate increased slightly to 62.7%, indicating that more people are entering the job market. Wage growth, while slowing, still outpaces recent inflation, which could help maintain consumer spending power.

The Bad

Job growth significantly undershot expectations, suggesting a loss of momentum in the labor market. The unemployment rate jumped to 4.3%, its highest level since October 2021, marking the fourth consecutive month of rising unemployment. This triggered The Sahm Rule, a historically reliable recession indicator, raising concerns about the economy’s trajectory. Average hourly wage growth slowed to 3.6% year-over-year, the smallest gain since May 2021. The jobs count for May and June was revised down by a combined 29,000, further highlighting the cooling trend in the labor market.

The Unknown

Economists, including Claudia Sahm herself, caution that unique post-pandemic factors like increased immigration may be affecting the Sahm Rule’s reliability in this case. The Federal Reserve’s next moves are uncertain, with some analysts now predicting a potential 50-basis point cut in September. It remains to be seen whether this jobs report represents a temporary slowdown or the beginning of a more significant economic shift. Additionally, the impact of Hurricane Beryl on the July figures adds another layer of complexity to interpreting the data.

Conclusion

July’s jobs report paints a picture of a cooling labor market, with slower job growth, rising unemployment and moderating wage increases. While the economy continues to add jobs, the pace has significantly slowed, and signs of weakness are becoming more apparent. This cooling could be seen as a necessary step towards a more balanced labor market and could help ease inflationary pressures. However, it also raises concerns about the potential for a harder economic landing. The Federal Reserve faces a delicate balancing act while the interplay between employment trends, wage growth, inflation and monetary policy shape the economic landscape in the coming months.