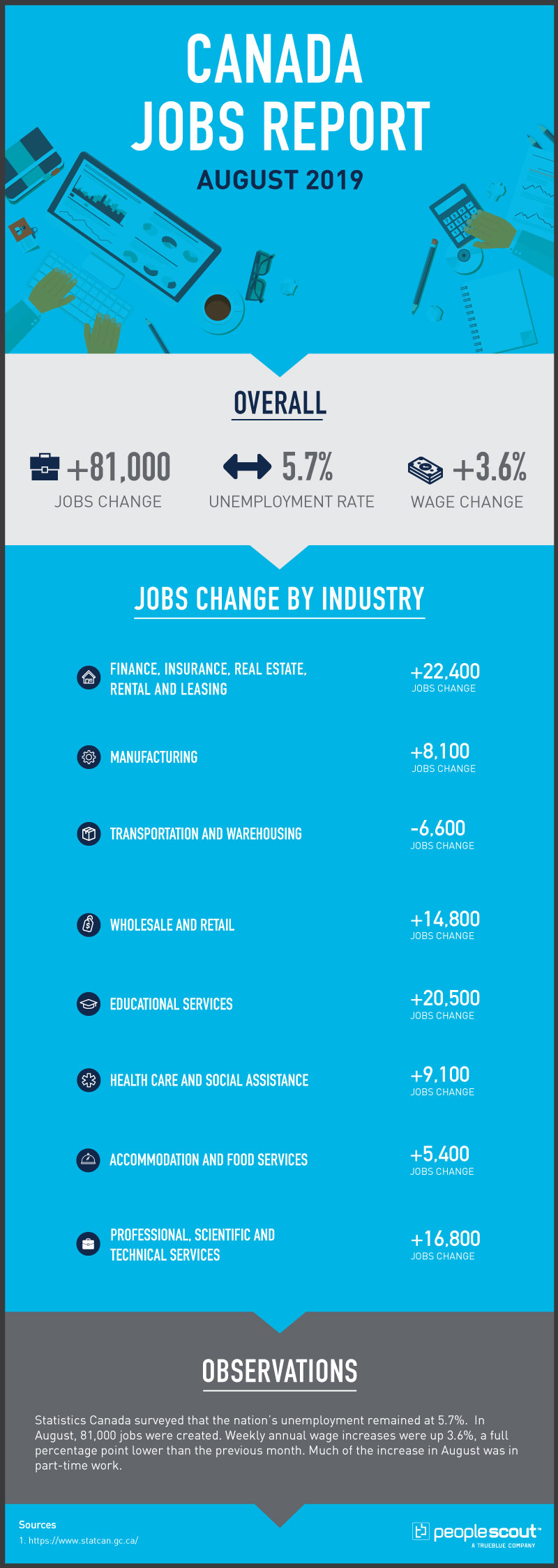

Statistics Canada surveyed that the nation’s unemployment remained at 5.7%. In August, 81,000 jobs were created. Weekly annual wage increases were up 3.6%, a full percentage point lower than the previous month. Much of the increase in August was in part-time work.

The Numbers

+81,000: The Canadian economy added 81,000 jobs in August.

5.7%: The unemployment rate remained steady at 5.7%.

3.6%: Weekly wages increased by 3.6% over the past year.

The Good

The headline number in the August jobs report is good news for the Canadian economy. The 81,000 jobs added quadrupled the 20,000 job increase that analysts expected, according to Bloomberg. The increase is more than five times larger than Reuters economists expected, at just 15,000. Over the past year, Canada has added 471,300 jobs, the highest number since 2003. With this increase, the unemployment rate remained at 5.7%, which is near a historic low.

Ontario saw the biggest increase in jobs with 58,000 new positions, while Quebec, Manitoba, Saskatchewan and New Brunswick also gained jobs. Unemployment stayed steady for most of the country, but British Columbia and Nova Scotia saw an increase in their unemployment rates as more people started looking for work, CBC reports.

The Bad

While the 81,000 number looks great, the majority of the positions created are part-time jobs. The Global News reports that 57,200 of the newly created jobs are part-time Additionally, 42,000 of the positions are held by workers under 24-years-old. However, the majority of the jobs created over the past year have been full-time positions.

The Unknown

For those with questions about whether the Bank of Canada would consider a rate cut, the latest report indicates that is unlikely, Reuters reports.

However, according to The Wall Street Journal, some experts say the looming global downturn could start to have more of an effect on the Canadian economy.

“’We expect the global slowdown to take a more material bite’ by the fourth quarter, CIBC World Markets economist Avery Shenfeld said. He said that could prompt the Bank of Canada to lower interest rates in late December or early next year.”

![[Webinar] Smart Hiring in the AI Age: What UK Candidates Are Really Doing in 2025](https://www.peoplescout.com/wp-content/uploads/2025/05/AI-enable-applicant-report-320x320.jpg)