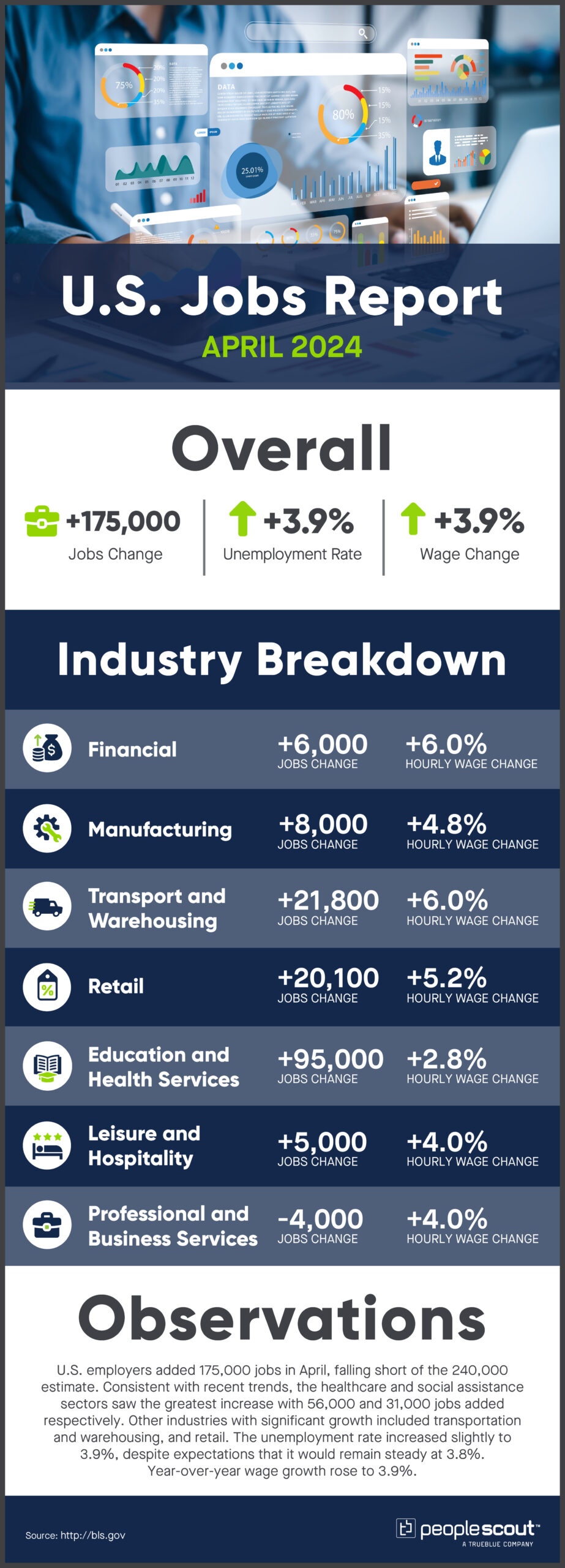

U.S. employers added 175,000 jobs in April, falling short of the 240,000 estimate. Consistent with recent trends, the healthcare and social assistance sectors saw the greatest increase with 56,000 and 31,000 jobs added respectively. Other industries with significant growth included transportation and warehousing, and retail. The unemployment rate increased slightly to 3.9%, despite expectations that it would remain steady at 3.8%. Year-over-year wage growth rose to 3.9%.

The Numbers

175,000: U.S. employers added 175,000 jobs in March.

3.9%: The unemployment rate rose to 3.9%.

3.9%: Wages rose 3.9% over the past year.

The Good

While job numbers fell short of expectations, the increase is still strong by historical standards. Many economists say the moderate pace of hiring, coupled with last month’s slowed wage growth, are just what the Federal Reserve hopes to see, after keeping interest rates at a two-decade high to fight persistently high inflation. The report was published just two days after the Fed voted to hold borrowing rates steady. Hourly earnings rose 0.2% from March and 3.9% over last year, both below estimates, alleviating concerns of wage growth-driven inflation. The New York Times reported strong labor participation, with women between the ages of 25 and 54—considered prime working years—reaching their highest participation rate ever, at 78%.

The Bad

Last month’s hiring was down significantly from the blockbuster increase of 315,000 in March and fell short of the 240,000 gain economists had predicted for April. The majority of job gains were seen within select industries—with healthcare accounting for a third of April’s job growth. As reported by the Wall Street Journal, slowed growth was particularly notable in the government, leisure and hospitality, and construction sectors. Consumers have begun reporting signs of a deteriorating job situation and are feeling less positive about the job market and are concerned about future business conditions, job availability and income, according to respondents of a recent Conference Board survey.

The Unknown

The April jobs data should help Fed officials regain confidence that inflation will drop to their target of 2%, but it’s going to take time. While Fed Chair Jerome Powell has said it’s unlikely rates will be raised further, the Wall Street Journal reported he has also indicated it will likely take more than a small increase in the unemployment rate—like that seen in April’s report—for the Fed to respond by lowering interest rates. Economists agree conditions could shift quickly, with the demand for workers already easing as job openings decline and fewer workers are voluntarily leaving their jobs.

Conclusion

The U.S. job market may be cooling as some experts have been anticipating for a while. While this could mean rate cuts will follow, the Fed has made it clear that one month of jobs data will have little impact on their decisions. Instead, officials will look at economic data in totality, keeping a close eye on the job market while maintaining their wait-and-see approach.